Simple, fast, and affordable personal loans

Discovery Bank Personal Loans give you fast, easy access to funds for life's big moments. With our personal loans, you can:

- Apply in-app anytime

- Get up to R500,000 in as little as 48 hours

- Repay with one fixed monthly instalment over a term you choose

- Get a personalised interest rate, with an up to 5%* discount when you manage your money well.

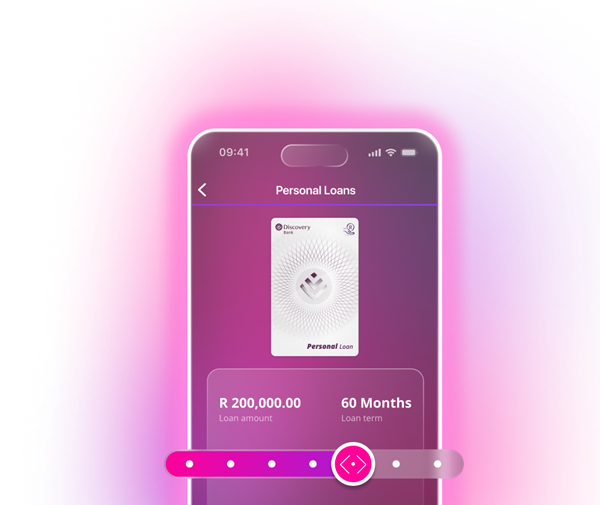

Apply in just a few taps

Apply for R15,000 up to R500,000 anytime in the Discovery Bank app. No queues, no paperwork. Faster than any online loan application.

Funds in 48 hours

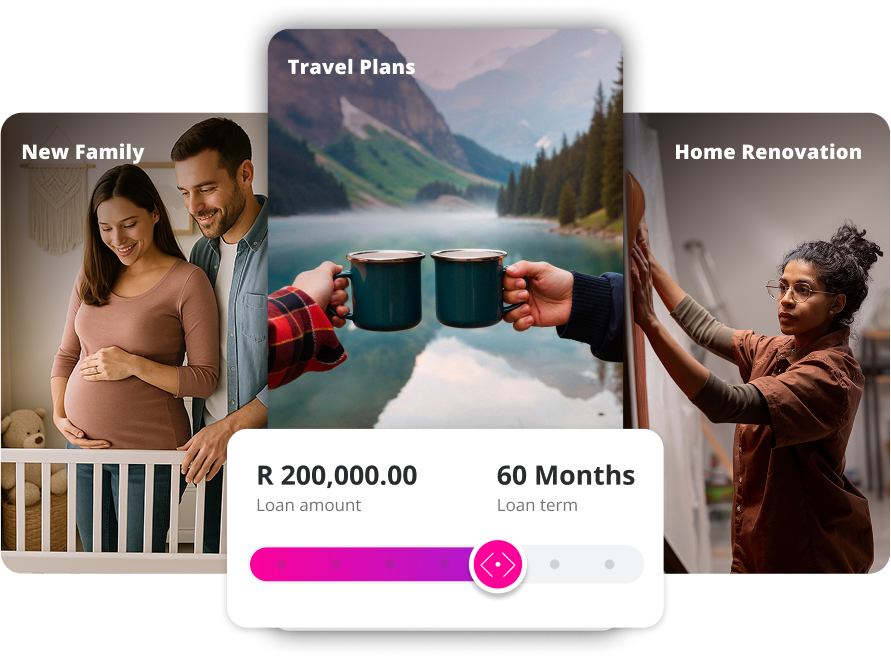

Get funds paid directly into your Discovery Bank account within 48 hours, and use your personal loan for whatever you need.

Your loan, your terms

Repay with one fixed monthly instalment with the flexibility to choose your term of 6 up to 72 months.

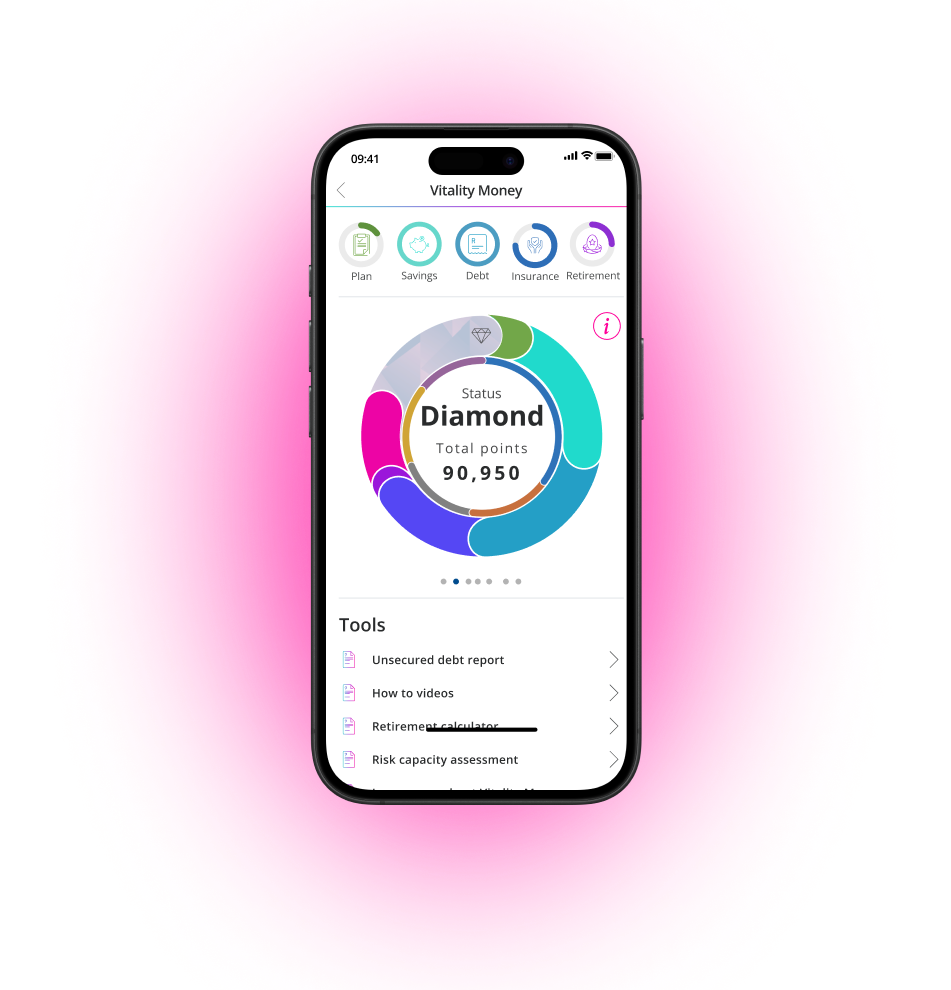

Lock in up to 5% off

Get a personalised interest rate, with a discount of up to 5%* based on your Vitality Money status.

Fast, in-app loan application

for life's big moments

Don't delay your dreams, apply for a Discovery Bank Personal Loan in minutes and borrow between R15,000 and R500,000. Enjoy the flexibility of choosing to repay it over a term of six months to up to six years. View and track your repayments seamlessly in the banking app. From big goals to everyday needs, a Discovery Bank Personal Loan makes it simple to access funds, fast.

LIMITED OFFER

Save up to 5%

on your monthly personal loan repayments

Unlock a lower interest rate - and lower monthly repayments - just for managing your money well. With Vitality Money, Discovery Bank clients can save up to 5% in interest over the full term of the personal loan.

How to apply for a personal loan

From tap to transfer,

we make it seamless.

- Log in to your Discovery Bank app.

- Tap Accounts, then add Account.

- Tap Personal Loan.

- Fill in the required information.

- Review your offer and tap Get this.

- Follow the steps to submit your application.

Read our frequently asked questions

Get all the answers you need about how personal loans work.

Asking yourself, do I qualify for a personal loan? There are basic things you need to qualify or apply for a personal loan:

- You must be 18 years or older.

- Have a valid South African identity document.

- Show proof of residence that is not older than three months.

- Provide proof of income (the bank may ask you for a payslip and for bank statements).

The bank will also check your credit score, which shows how well you manage credit, and your income (to see what you can afford). If approved, your personal loan will be offered at a specific interest rate. Having a good credit score and credit history can mean the bank will offer you a lower interest rate.

To apply for a personal loan with Discovery Bank, you must be the Discovery Bank primary accountholder or a secondary cardholder on any of these products:

- Discovery Bank Suite

- Discovery Bank Credit Card

- Discovery Bank Transaction Account with bundled fees

- Discovery Bank Transaction Account with pay-as-you-transact fees

- Ðiscovery Account

- Savings Account

- Your account must be in good standing as defined here.

- You can only apply for a personal loan when you don't have any other or pending Discovery Bank credit applications in progress.

- You must agree that we can retrieve and use your credit bureau information in the assessment of your application.

There is no need to visit a branch or website. In the Discovery Bank app, simply add a personal loan account and complete the steps.

Once you've applied, we'll perform a credit and affordability assessment.

- If you have a Discovery Bank account with your income paid into it, you won't have to send any other documents. Discovery Bank will check your details automatically and, if needed, ask you for more information.

- If you have a Discovery Bank account, but your income isn't paid into it, you'll need to send your proof of your income.

How long it takes to get a personal loan depends on the financial institution or bank. Generally, a personal loan application does not take long when you meet all the age, income and credit or account requirements and have the documents you need.

It's possible to apply for a personal loan in minutes in the Discovery Bank app - the easy steps in the app make it faster than any branch or online personal loan application.

Discovery Bank clients can go to the app, add a personal loan account, choose the amount and the personal loan repayment term, and accept - all within minutes. If your personal loan is approved, funds could be paid into your Discovery Bank account within 48 hours.

With Discovery Bank being a branchless bank, your details are verified electronically when your income is paid into your account, and you'll have a decision about your personal loan, a personalised interest rate and money in your account within 48 hours or even shorter. The only time your Discovery Bank personal loan can take a bit longer, is if you need to send documents on request, for example, when your income is not paid into your Discovery Bank account.

You can pay a personal loan over a term that your bank offers, which can range from six months and up to six years, depending on the amount you loan. It is also possible to pay a personal loan off sooner by paying more into your loan than the monthly set amount or by settling the loan in one lump-sum payment. If you want to settle a personal loan before the loan term ends, you need to get the settlement amount, which can differ from the outstanding amount due to interest.

Discovery Bank personal loans offer flexible loan terms, meaning you can choose how long you take to pay a personal loan. These flexible payment terms you can choose from to repay your Discovery Bank personal loan can range from 6, 12, 18, 24, 36, 48 or 60 and up to 72 months. The period you choose can be based on what you can afford to repay and can be shorter to save on interest and to make sure you manage your short-term credit well.

A personal loan, in the context of the South African Reserve Bank (SARB), refers to a loan taken out by any person from a financial institution, typically a bank. A personal loan is a fixed amount of money that you borrow and repay over an agreed period with interest and fees. You can use the money for anything you need, like home improvements, travel, education, or unexpected expenses.

A personal loan from Discovery Bank offers you fast application and approval in the Discovery Bank app when you qualify to apply for a personal loan.

Interest you pay on a personal loan is the cost added to the loan like a fee you pay for borrowing money. The interest on a personal loan in South Africa is linked to the prime lending rate and based on the repo rate set by the South African Reserve Bank. The interest you pay on a personal loan is calculated as a percentage of the loan amount that you choose and influenced by your credit score. It is possible for the interest rate on your personal loan to fluctuate (up or down) over the repayment period or loan term when there are changes to the repo rate.

With Discovery Bank, the interest rate on your personal loan is linked to the prime lending rate and personalised to your credit profile. This means your personal loan interest rate - and monthly repayments - may go up or down if the prime lending rate changes during your loan term. From time to time, the interest rate on your Discovery Bank personal loan may also be linked to specific special offers. When you have more than one personal loan with Discovery Bank, the interest rate on each loan may also differ due to the credit assessment at the time of activating the personal loan.

A personal loan has costs you need to consider. These costs include:

- The personal loan amount

- Interest (based on the prime lending rate and your credit score)

- Once-off credit initiation fee (paid when the loan is approved and based on guidelines in the national credit act)

- Monthly credit service fee.

Discovery Bank will give you a clear breakdown of the cost of your personal loan, which includes the total monthly instalment, the interest and other fees, before you accept your offer. If you have an existing Discovery Bank account, you can apply for a personal loan in the Discovery Bank app by adding an account.

To apply for a personal loan with Discovery Bank, you must be a Discovery Bank client. Personal loans are available to existing Discovery Bank clients who are the primary accountholder or a secondary cardholder on any of the following products:

- Discovery Bank Suite

- Discovery Bank Transaction Account

- Discovery Bank Credit Card

- Ðiscovery Account

- Savings Account

There is no set minimum or maximum amount you can borrow with a personal loan in South Africa. The minimum or maximum amount would depend on the financial institution, typically a bank, that you approach for a personal loan and can range from R1,000 to R1,000,000. The approval of a personal loan depends on your creditworthiness or credit score and affordability or what you can afford to repay over the loan term.

If you want to apply for a Discovery Bank personal loan, you can choose any amount from R15,000 and up to R500,000 when you apply in the Discovery Bank app. If you want a personal loan for an amount that is lower or higher than this, you can contact us.

The interest rate on a personal loan is not fixed, so it is possible for the interest rate on your personal loan to fluctuate (up or down) over the repayment period. This is because, in South Africa, the interest on a personal loan is linked to the prime lending rate and based on the repo rate set by the South African Reserve Bank, which can change.

Discovery Bank personal loans offer variable interest rates that's linked to the prime lending rate. This means your interest rate - and your monthly repayments - can change when the prime lending rate goes up or down based on the repo rate. Any discount on the interest rate that you qualify for through Vitality Money is fixed upfront and will give you a discount on the interest rate Discovery Bank offers (based on the prime lending rate). This discount on the interest rate will remain in place for the full term of your loan or for the duration of an agreed special offer.

Personal loan costs include:

- The personal loan amount

- Interest (based on the prime lending rate and your credit score)

- A once-off credit initiation fee (paid when the loan is approved and based on guidelines in the national credit act)

- Monthly credit service fee.

When you take out a Discovery Bank personal loan, the once-off credit initiation fee will be charged when your loan is activated. This initiation fee will be based on the standard set by the national credit act, and we will confirm the costs when we give you your personal loan offer.

You'll be charged a monthly credit service fee of R69. This fee can change, and we will let you know when this happens.

To make sure you always get the best possible interest rate on loans, take care of your credit score. Your credit score and how you manage debt determine your creditworthiness. It helps to manage your credit and short-term debt well by keeping balances lower than your credit limit and making extra payments.

Discovery Bank will look at your credit score and other details to give you a loan offer. As part of a special offer, you can get a discount on your personal loan interest rate based on your Vitality Money status.

Interest rate discount based on Vitality Money status:

| Vitality Money status | Blue | Bronze | Silver | Gold | Diamond |

| Vitality Money discount | 0% | 0,5% | 1% | 3% | 5% |

With this offer, it's possible to lock in a personalised interest rate (which can change based on changes to the prime lending rate) on your personal loan and lock in up to 5% off this personalised interest rate when you accept the offer.

Here is an example: the personalised interest rate you qualify for is 22%, based on your credit score and prime lending rate guidelines. Your Vitality Money status is Diamond, which gives you the maximum interest rate discount of 5%. This means the interest rate for the full term of your loan is 17%, regardless of future changes to your Vitality Money status.

The interest rate discount you qualify for is based on your Vitality Money status when you apply. This specific discount will remain in place for the full loan term and won't change, even if your Vitality Money status changes. Try to improve your Vitality Money status before you apply.

When the prime lending rate changes, we will adjust the personalised interest rate on your personal loan and apply the same interest rate discount based on your Vitality Money status when you applied for the loan.

To get the best possible interest rate on a personal loan, you'll need a strong credit profile.

With Discovery Bank, a higher Vitality Money status at the time you apply for a personal loan can also give you the best interest rate discount. Your personalised interest rate is linked to the prime lending rate, and with Vitality Money, you can lock in a discount of up to 5% on the personalised interest rate.

Interest rate discount based on Vitality Money status:

| Vitality Money status | Blue | Bronze | Silver | Gold | Diamond |

| Vitality Money discount | 0% | 0,5% | 1% | 3% | 5% |

The interest rate discount is based on your Vitality Money status when you apply and won't change once your loan is approved. So, it's worth improving your financial behaviour and status before applying. When the prime lending rate changes, we will adjust the personalised interest rate on your personal loan and apply the same interest rate discount based on your Vitality Money status when you applied for the loan.

Yes. You can settle a personal loan anytime by depositing money into your personal loan account. If you want to settle a personal loan before the loan term ends, you need to confirm the settlement amount, which can differ from the outstanding amount due to interest.

If you settle your Discovery Bank personal loan early, you won't have to pay any further interest or fees. Your personal loan account will stay open for 40 days.

To get a letter showing the settlement amount on your personal loan:

- Go to Accounts in the Discovery Bank app.

- Scroll to and tap on your personal loan account.

- Tap the menu symbol at the top right.

- Scroll down and tap Request settlement quote.

You'll also see a settlement letter in the Discovery Bank app, here:

- Tap More at the bottom of the screen.

- Scroll to Document repository and tap Other documents.

- Tap Letters.

Not a Discovery Bank client yet?

Choose from a transaction account for your everyday banking needs, a state-of-the-art standalone credit card or get the full banking experience with a Discovery Bank Suite - it's the account that gives you the best rewards.

Download the Discovery Bank app to get started or

Join now