SpendTrend25 shows there's a growing appetite among South Africans for rewards, flexibility, and better value when it comes to everyday spending. Here's how to choose a credit solution that works for your wallet - and your lifestyle - with Discovery Bank.

South Africans are relying more on credit - but not just for borrowing.

According to the latest SpendTrend25 report from Discovery Bank and Visa, the number of credit cards in use in South Africa has jumped by 53% since 2020 - but people aren't simply spending more. They're using credit more strategically.

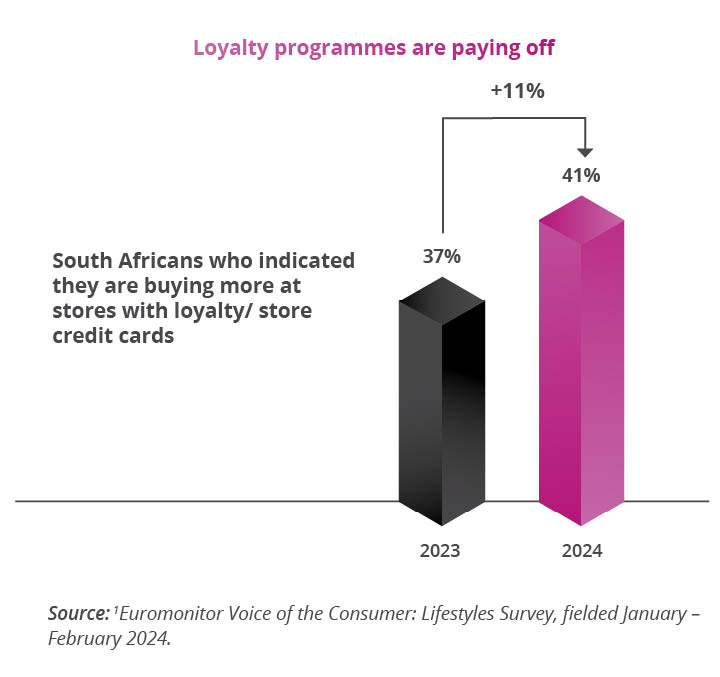

With 86% of people feeling the squeeze of rising living costs, they're demanding more from every transaction. The big shift? Rewards-driven spending.

Today, 84% of consumers prioritise rewards and cash back when choosing which credit card to use. People want their spending to do more - and smart rewards are leading the charge.

A better way to use credit: Spend smarter, earn more

While more people hold multiple cards, they're using them more intentionally - often spending less, but making each swipe or tap count. Two clear trends are shaping this behaviour:

- New credit users are entering the market with lower limits

- Existing users are optimising their spend to maximise rewards

It's no longer about using credit more - it's about using it better. With over 80% of consumers more engaged with their credit card benefits than a year ago, the message is clear: value matters.

Are you rewarded for smarter credit behaviour?

Discovery Bank is designed for a new era of intentional spending. Here's how it helps you earn more, save more, and stress less:

- Vitality Money rewards: Get up to 75% back on HealthyFood, fuel, flights, and more - just for making good money decisions.

- Credit card lifestyle rewards: Earn Ðiscovery Miles and get exclusive discounts from partner stores and brands.

- One flexible credit facility: Use a single powerful credit facility for your credit card and overdraft - making it easier to track, manage, and optimise your limit.

- Flexible, alternative credit options: Need quick access to funds? Get personalised offers and flexible repayment terms, right in your banking app.

- Lower interest rates based on your behaviour: The better your Vitality Money status, the more you save on interest.

Make your credit work harder

Our research shows that South Africans are increasingly choosing credit cards based on how much they get back - and that's smart. With Discovery Bank, everyday spending turns into everyday rewards. Whether you're filling up, flying out, buying groceries or buying a home, your credit facilities and credit card should work as hard as you do.

Think your card could be giving you more? Put it to the test

Use this easy comparison tool to compare your current bank's credit card to Discovery Bank's and see how the rewards stack up. See for yourself if you could be earning more back every time you tap!

The Future of Banking. Now.

- This article is meant only as information and should not be taken as financial advice. For tailored advice, please contact your financial adviser.

- Discovery Bank Ltd. Auth FSP 48657. Limits, Ts & Cs apply. Rewards based on your engagement in Vitality programmes, Discovery products, and monthly qualifying card spend. Credit initiation and service fees may apply. Subject to credit approval.